We have made every effort to keep our website free of jargon, but realise that some expressions might need further explanation. This glossary is intended to help you understand some of the terms used in impact investing.

Sorry, no results found.

A reduction in absolute carbon refers to the total quantity of greenhouse gas being emitted. This is as opposed to a reduction in carbon intensity which refers to the volume of emissions per unit of GDP.

Active investing is a hands-on approach to investing. An actively managed portfolio of investments are all selected by the portfolio manager and investments are sold and bought on an ongoing basis. Active investing involves deeper analysis – a portfolio manager usually oversees a team of analysts who look at qualitative and quantitative factors.

The process through which investors engage with companies and exercise their voting rights. Good active ownership requires research, prioritisation, setting objectives, tracking results, integration with investment decision making, persistence, consistency and listening skills.

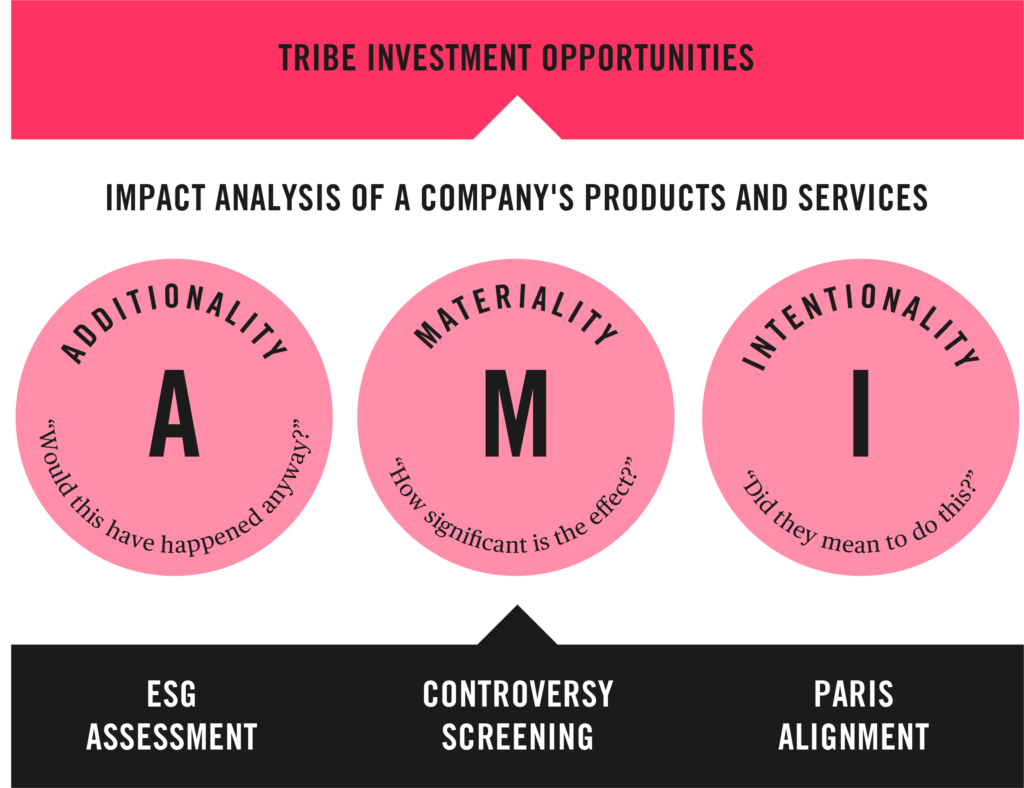

What if the company didn’t exist? Is it providing a crucial product or service?

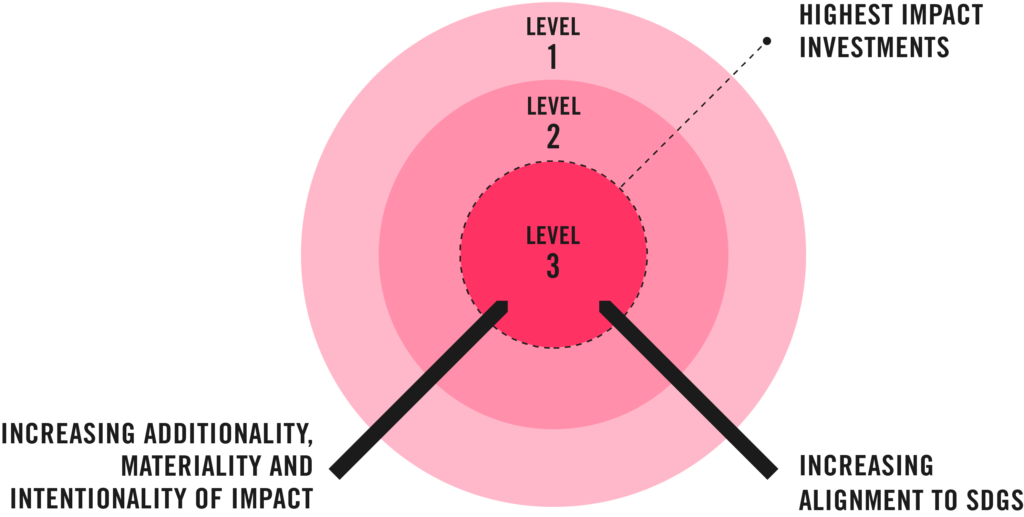

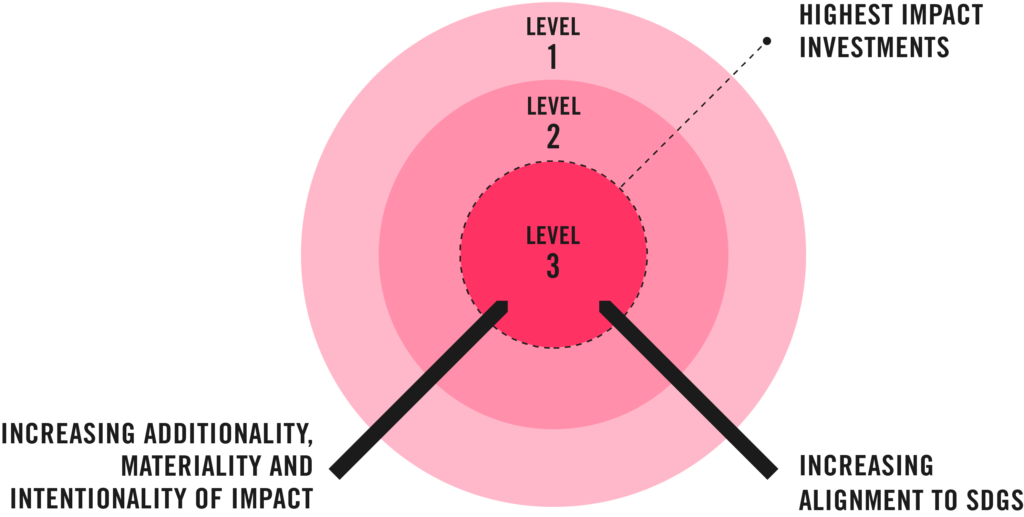

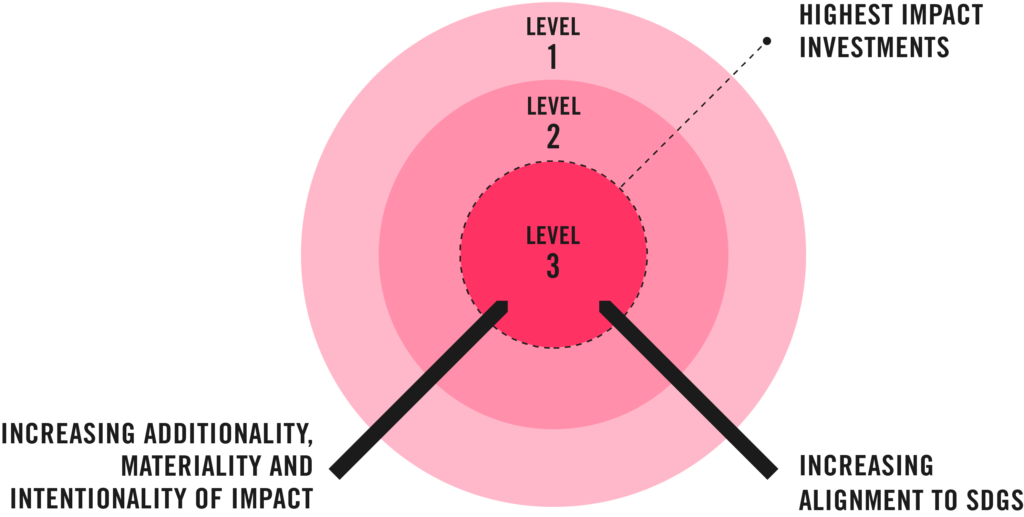

Tribe’s proprietary framework and process that identifies impact. It considers a business’ “Additionality”, “Materiality” and “Intentionality” (AMI) and is used to understand the potential depth and scale of impact a business can deliver.

An advisor makes investment recommendations but all final decisions belong to the client.

This refers to the total volume of assets at year end that Tribe manages either as discretionary or in an advisory capacity.

Investments that aren’t part of the traditional asset classes like equity, income and cash, such as real estate, commodities or infrastructure. They may be used to diversify an investment portfolio.

A measure of comfort with investments that may be unfamiliar, uncertain and unpredictable. A lower degree of ambiguity tolerance leads to a greater need for familiarity and targeted narratives.

A group of investments or securities which have similar financial characteristics such as equities, fixed income, alternatives and cash.

Certified B Corporations, or B Corps, are companies who meet high standards of social and environmental performance, transparency and accountability. To become a B Corp, businesses must go through a rigorous certification process, by B Lab (a charity), which measures their social, governance and environmental performance. To become certified, B Corps must sign a legal agreement to confirm their board members will always consider the impact on their stakeholders when making decisions.

The capturing and storing of green energy that isn’t needed at the time of generation and is saved until it’s needed.

Facilities which enable the capturing and storing of green energy that isn’t needed at the time of generation, releasing the energy when it is needed.

A standard or point of reference against which things may be compared.

The Better Business Act campaign is aiming to change UK law to make sure every company in the UK places people, profit and planet at the heart of their purpose and the responsibilities of their directors. The Better Business Act is a proposal to amend Section 172 of the Companies Act 2006 so companies are legally obligated to operate in a manner that benefits their stakeholders, including workers, customers, communities and the environment, while seeking to deliver profits for shareholders.

Refers to every living thing, including plants, bacteria, animals, and humans. Biodiversity is a term used to describe the enormous variety of life on Earth. It can be used more specifically to refer to all of the living species in one region or ecosystem.

This refers to our exposure through our funds to companies using biomass as a source of fuel.

Usually referring to a trading bloc, for example, the European Union.

The sustainable use of ocean resources for economic growth, improved livelihoods and jobs, while preserving the health of the marine and coastal ecosystem.

Natural gas is used as the main feedstock (raw material) into a steam methane reforming (SMR), partial oxidation (POX) or autothermal reforming (ATR) process that creates the hydrogen. Carbon emissions are captured and stored using carbon capture and storage (CCS) technologies.

Coal is used as the feedstock (raw material) into the gasification process that creates hydrogen.

The tax that arises when an asset is sold at a profit, subject to jurisdiction and allowances.

A not-for-profit charity who runs the global disclosure system for investors, companies, cities, states and regions to help manage their environmental impacts.

The cumulative amount of carbon dioxide (CO2) emissions permitted over a period of time to keep within a certain temperature threshold.

CO2 is an important heat-trapping (greenhouse) gas, which is released through human activities such as deforestation and burning fossil fuels, as well as natural processes such as respiration and volcanic eruptions.

A carbon dioxide equivalent or CO2 equivalent, abbreviated as CO2-eq is a metric measure used to compare the emissions from various greenhouse gases on the basis of their global-warming potential (GWP), by converting amounts of other gases to the equivalent amount of carbon dioxide with the same global warming potential.

Carbon intensity compares the amount of emissions to some unit of economic output (e.g. GDP or per million £/$ of sales).

A market where carbon emission allowances are traded.

The process of capturing and storing atmospheric carbon dioxide.

A gift of cash or property to a non-profit organisation.

A concept that relates to the use of regenerative materials in product development, and a shift in consumer behaviour that encourages those products to be kept in use for as long as possible. Circularity also provides pathways for reuse, recycling and biodegradation at the end of life.

The catastrophic and fast accelerating nature of global warming currently being experienced.

Risk assessments based on formal analysis of the consequences, likelihoods and responses to the impacts of climate change and how societal and regulatory constraints shape adaptation options.

CVaR is designed to provide a forward-looking and return-based valuation assessment to measure climate related risks and opportunities in an investment portfolio.

Behavioural measure of reactivity along the investment journey — tendency to trade, monitor and react to events.

A lower number or less diversified portfolio of investments within securities, sectors, industries or geographical regions.

The Convention of the Parties to the United Nations Framework Convention on Climate Change (UNFCCC). The COP is the highest decision-making body of the Convention. All States that are Parties to the Convention are represented at the COP, at which they review the implementation of the Convention and any other legal instruments that the COP adopts and take decisions necessary to promote the effective implementation of the Convention, including institutional and administrative arrangements.

Every year the UNFCCC hosts the COP to drive action on climate change. As of the start of 2022 there have been 26 COPs with the last being in Glasgow, Scotland.

A process to identify the level of social, environmental and/or economic controversies (historical, present and ongoing) that a business is exposed to.

The new standard for Net Zero plans for corporations set by the Science Based Target Initiative (SBTi). More information can be found here.

The asset classes used by a corporation (in this case a financial services corporation) that are covered by any Science Based Target that has been set by that corporation.

Refers to the process through which everything is designed to be disassembled and safely returned to the soil as biological nutrients or re-utilised as high-quality materials for new products as technical nutrients without contamination.

Synonymous with fixed income – securities where the security issuer is obligated to repay investors the amount they borrowed plus an interest margin.

EU regulation, announced in 2023, which seeks to improve domestic capacity and supply chain security around the extraction, processing, recycling, and import of critical raw materials such as nickel and lithium by 2030.

Issues, conversations, and engagements that may be multi-faceted in their nature due to the number of thematic issues that may be in discussion. Where these issues are not clearly aligned to just one thematic area we refer to this as cross cutting.

A financial institution which securely holds securities and investments.

The removal or reduction of carbon dioxide (CO2) output into the atmosphere.

Can be used to mitigate an investor’s overall risk profile by diversifying a portfolio to invest in more than one type of asset, for example to protect against currencies, credit and interest rate moves. A derivative is a contract between two or more parties whose value is based on an agreed-upon underlying financial asset (like a security) or set of assets (like an index).

When an investor owns part of the company through direct investment as opposed to investment via a fund.

An expert advisory group made up of key financial market stakeholders and subject matter experts. The group provides independent advice to the FCA on the development and implementation of new sustainability-related financial disclosure requirements (‘disclosures’) and a sustainable classification and labelling system for investment products (‘labels’).

Investment decisions are made by an advisor rather than the end client.

Different types of investments, across a range of markets, that don’t rely on the same things to do well at any one time.

Donors can take several forms including individuals, families, or companies setting up a philanthropic vehicle to facilitate charitable giving.

A philanthropic vehicle which facilitates charitable giving on behalf of donors. DAFs are created under an umbrella charity of a sponsoring organisation which administers the fund on behalf of the donor.

A giving account established at a public charity. It allows donors to make a charitable contribution, receive a tax deduction and recommend grants from the fund over time.

A financial risk associated with a loss. An estimation of a security’s potential loss in value if market conditions result in a decline in that security’s price.

A measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates. The longer the duration the greater the sensitivity.

A classification system, that establishes a list of environmentally sustainable economic activities. It has the potential to play an important role in helping the EU scale up sustainable investment and implement the European green deal. The EU taxonomy would provide companies, investors and policymakers with appropriate definitions for which economic activities can be considered environmentally sustainable. Through this, it should create security for investors, protect private investors from greenwashing, help companies to become more climate-friendly, mitigate market fragmentation and help shift investments where they are most needed. Currently there are both green and social taxonomies agreed by the EU.

The direct and indirect contributions of ecosystems to human wellbeing which have an impact on survival and quality of life. There are four types of ecosystem services: provisioning, regulating, cultural and supporting services:

A provisioning service is any type of benefit to people that can be extracted from nature;

A regulating service is the benefit provided by ecosystem processes that moderate natural phenomena. Regulating services include pollination, decomposition, water purification, erosion and flood control, and carbon storage and climate regulation;

A cultural service is a non-material benefit that contributes to the development and cultural advancement of people, including how ecosystems play a role in local, national, and global cultures; the building of knowledge and the spreading of ideas; creativity born from interactions with nature (music, art, architecture); and recreation; and

Supporting services are the natural processes, such as photosynthesis, nutrient cycling, the creation of soils, and the water cycle that sustain ecosystems. These processes allow the Earth to sustain basic life forms, whole ecosystems and people.

Focuses on the social fabric needed to ensure everyone thrives – the social foundation.

Countries engaging in global markets which are less economically developed than developed countries. Investments into companies in these countries could be more volatile due to certain risks such as political instability and/or weaker governance structures.

Also known as ‘cap and trade’, an ETS is a market-based, cost-effective approach towards reducing greenhouse gas (GHG) emissions. Governments economically incentivise firms, corporations, and other entities to cut emissions by setting a limit (a ‘cap’) on emissions and issuing permits within the limit that each allow for one tonne of GHG emissions. Permits must be obtained, either from the government or through trade with other firms, and surrendered per unit of emissions. The cap is lowered over time to ensure emissions fall. Firms therefore, if insufficient in their quantity of permits, must either reduce emissions or purchase more permits – where a given permit price is always equal to one tonne of CO2.

The process of reducing the amount of energy required to provide products and services.

The active dialogue between investors and companies on environmental, social and governance factors – as well as the impact of that business in the marketplace, on society and the environment.

Captures the economic and physical infrastructure needed to deliver the SDGs.

The sum of the market capitalisation of ordinary shares at fiscal year end, the market capitalisation of preferred shares at fiscal year end, and the book values of total debt and any minorities interests.

Represents the boundaries nature sets – the ecological ceiling or planetary boundaries.

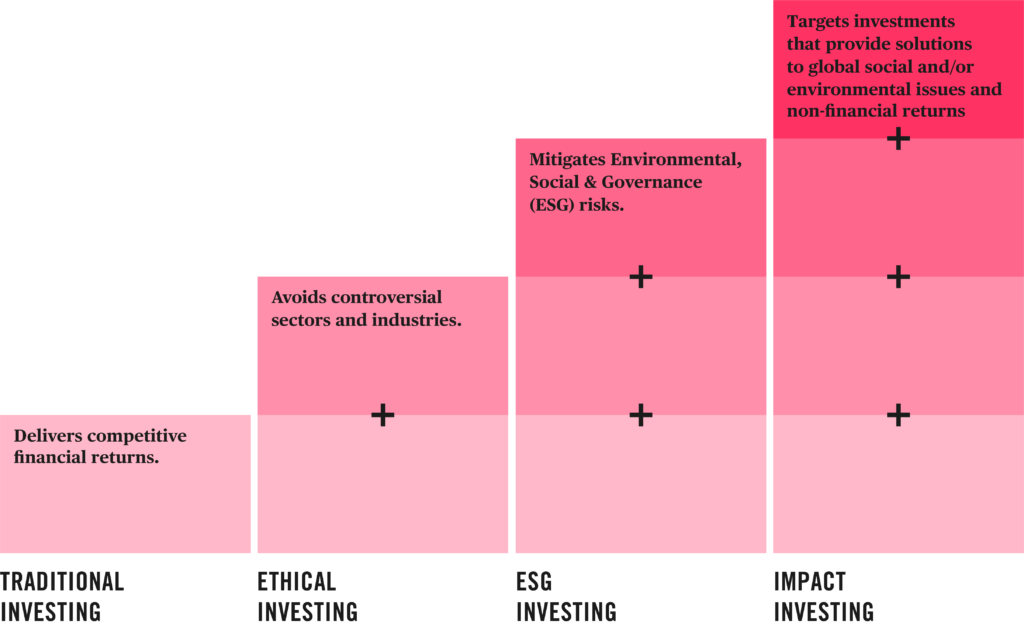

Environmental, Social and Governance (ESG) investing looks at the operations of a company and the potential environmental, social and governance risks associated with the way they operate.

The universe of traded company shares. Investments can fluctuate according to market conditions, the performance of individual companies and that of the broader equity market.

A process of directly questioning and monitoring a company to assess its focus on a range of issues, for example around ESG, voting and ownership.

Focuses on investments that are aligned to certain ethical and/or moral principles. Companies and industries that are deemed to be “unethical” are negatively screened out and excluded from portfolios.

The industries, businesses and/or geographies that an investment manager won’t invest in.

An externality can be both positive or negative and can stem from either the production or consumption of a good or service. An externality is a cost or benefit that isn’t financially incurred or received by the creator.

The new standard for Net Zero plans specifically designed for the financial services industry. It is due to be finalised and available in 2024. More information is available here.

An investment that pays a fixed amount of interest like a bond and typically aims to preserve capital.

The practice through which humans create, manage, plant, use, conserve and repair forests, woodlands, and associated resources for human and environmental benefits.

Decomposed buried carbon-based organisms that died millions of years ago. They create carbon-rich deposits that are extracted and burned for energy.

Predominantly stem from equipment leaks and qualify as unintentional losses. They may arise due to normal wear and tear, improper or incomplete assembly of components, inadequate material specification, manufacturing defects, damage during installation or use, corrosion, fouling and environmental effects.

A process of directly questioning and monitoring a fund manager to assess their conversations with investee companies to determine their focus on a range of issues, for example around ESG, voting and ownership.

A self-assessment a business can align themselves to, to ensure they’re managing and improving their social and environmental performance for the future by shifting their business to ‘positive pursuits’.

A business’s ability to thrive in the future based on the information and evidence of what could happen socially, environmentally and economically.

The practice of investing for financial return through the lens of female empowerment; considering the issues women and girls face around the world, the solutions to these challenges and the power of women’s leadership.

A UK tax initiative that enables tax-effective giving by individuals to charities in the United Kingdom allowing extra money to be claimed from HMRC.

Adopted at the COP26 UN climate conference in November 2021, the pact sees signatory countries increase climate ambition and action from the Paris Agreement in 2015, and sets out new rules to reduce greenhouse gas emissions including phasing down coal and a global carbon market.

The hub at the centre of the ethical finance movement. GEFI curates independent conversations from a broad coalition of financial services stakeholders, as well as delivering practical projects, campaigns and research. We are a member of the GEFI.

A measure of how much energy the emissions from 1 tonne of a gas will absorb over a given period of time, relative to the emissions from 1 tonne of carbon dioxide (CO2).

The aggregate contribution of all countries’ activities which release greenhouse gases (GHGs) and strengthen the global greenhouse effect.

Focuses on the political, cultural and legal systems and behaviours needed to drive the change required.

A financial donation to a charitable organisation that doesn’t have to be repaid and that’s used for charitable purpose.

Renewable electricity and water are used to generate hydrogen using the power of electrolysis.

The six main greenhouse gases covered by the Kyoto Protocol: Carbon dioxide (CO2); Methane (CH4); Nitrous oxide (N2O); Hydrofluorocarbons (HFCs); Perfluorocarbons (PFCs); and Sulphur hexafluoride (SF6)

Investors are willing to pay a premium to hold a green bond over a conventional bond.

Natural gas is used as the feedstock (raw material) into a steam methane reforming (SMR), partial oxidation (POX) or autothermal reforming (ATR) process that creates hydrogen.

Information that is known to be real or true, provided by direct observation and measurement (i.e. empirical evidence) as opposed to information provided by inference.

A person with liquid assets over £1 million (thresholds can vary).

An illustration of the possible financial performance of a given portfolio using historical data of notable market events as a guide.

A zero-carbon fuel burned with oxygen; provided that it’s created in a process that doesn’t involve carbon.

Investments made with the intention of generating social/environmental impact alongside a potential financial return. From climate change to gender equality, sustainable cities to government policy change, impact investing focuses on addressing major social and environmental challenges while aiming to generate financial returns.

Impact investing is often a way for investors to express their personal values through their investments: using businesses working to solve social and/or environmental problems.

An investment strategy that focuses on a specific impact area such as gender, poverty alleviation, climate etc. Gender lens investing, for example, is the practice of investing with an aim for financial return whilst also considering how those investments benefit women. Gender lens investing can include funding women-owned businesses, businesses with a strong track record of employing women, or companies that improve the lives of women and girls with their products and services.

A framework that hopes to make the practice of impact management mainstream. The framework identifies opportunities to consolidate existing sustainability resources, collectively address gaps, and coordinate with policymakers and regulators. More information can be found here.

A measure of comfort in accepting different levels of risk in pursuit of impact. A higher risk appetite implies a willingness to accept higher potential financial risk and volatility for greater social/environmental returns.

A measure of comfort in the balance between financial and social/environmental outcomes. A higher strength implies greater focus on social/environmental outcomes.

Based on research in sustainability and collaboration with leading behavioural scientists, the ImpactDNA™ process helps uncover and articulate the impact you want to have through your investments. An individual’s ImpactDNA™ is the backbone of their investment portfolio at Tribe.

An intuitive, forward-looking metric, provided by MSCI, that takes into account Scopes 1, 2 & 3 and forecasting how much the temperature of the world would increase if the whole economy had the same carbon overshoot or undershoot as the company in question, based on their projected 5 years of emissions and targets that have been set.

The rate at which prices increase over a period of time.

Refers to an Act in the United States, published in 2022 which sets in motion a suite of policies directing spending towards clean energy infrastructure, lower healthcare costs, and improved taxpayer compliance through the Internal Revenue Service (IRS).

Is the company aware of its positive impact and will it continue to build on that positive impact in the future?

The fixed return investors receive on debt securities. Usually refers to the rate set by Central Banks from which other debt instruments are valued. Declining interest rates generally increase the value of existing debt instruments, and rising interest rates generally reduce the value of existing debt instruments.

The objective of the IPCC is to provide governments at all levels with scientific information that they can use to develop climate policies. IPCC reports are also a key input into international climate change negotiations. Created in 1988 by the World Meteorological Organisation (WMO) and the United Nations Environment Programme (UNEP). The IPCC is an organisation of governments that are members of the United Nations or WMO. In 2022 the IPCC has 195 members.

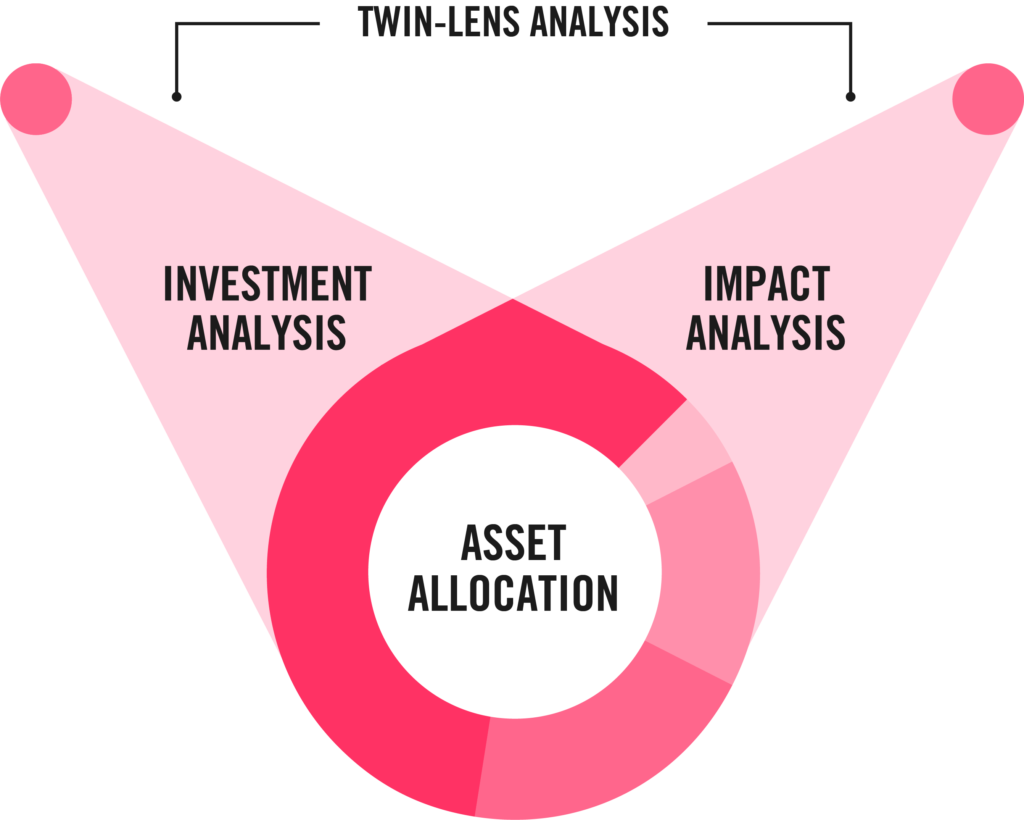

All tradable assets, for Tribe – those that have passed our twin-lens due diligence and have strong investment and impact credentials (also known as the approved list).

A set of criteria used to “screen out” certain types of investments that may be inconsistent with an investor’s personal values. These could be controversial business practices such as tobacco, armaments, oil or because they don’t meet defined ESG criteria or contribute to the delivery of the UN SDGs. Whilst this approach has historically been focused on a negative screening, it increasingly incorporates positive ESG criteria to identify companies with more sustainable practices than their industry peers.

Investments that a company would consider investing in, for Tribe, investments that have the potential to provide both financial and impact returns.

Securities or financial assets, such as equities or fixed income instruments, that an individual uses to move their money in the hopes of increasing returns.

The Kyoto Protocol operationalises the United Nations Framework Convention on Climate Change by committing industrialised countries and economies in transition to limit and reduce greenhouse gas (GHG) emissions in accordance with agreed individual targets. The Convention itself only asks those countries to adopt policies and measures on mitigation and to report periodically. In 2022, there are 192 Parties to the Kyoto Protocol.

The six greenhouse gases are covered by the Kyoto Protocol. Carbon dioxide (CO2); Methane (CH4); Nitrous oxide (N2O); Hydrofluorocarbons (HFCs); Perfluorocarbons (PFCs); and Sulphur hexafluoride (SF6)

How easily an asset or security can be converted to cash. The frequency and amount an asset or security trades without affecting its market price.

The shift from an economy that depends heavily on high carbon fossil fuels and activities to a sustainable, low carbon economy with fewer carbon intense activities.

An index configured by MSCI incorporating selected companies from developed and emerging economies based on a minimum size criteria.

The value of a company that is traded on the stock market, calculated by multiplying the total number of outstanding shares by the present share price.

Needed to address a basic human or environmental need that doesn’t compromise the social or environmental integrity of society or the planet’s ecosystems.

How significant is the impact this company is having? What is the material difference it’s delivering?

A type of banking which provides financial services to low income individuals or groups of people who would otherwise have no access to finance.

Loans with a value less than $1000, usually associated with entrepreneurs in emerging economies in microfinance.

The world’s stocks of natural assets which include geology, soil, air, water and all living things. It’s from this natural capital that humans derive a wide range of services, often called ecosystem services, which make human life possible.

Natural gas is a non-renewable hydrocarbon used as a source of energy for heating, cooking, and electricity generation.

A third party data provider we work with to help us better understand the social and environmental performance of our clients’ portfolios.

Reducing absolute greenhouse gas emissions to as close to zero as possible. This is done via reductions in core emissions (through process efficiencies and product adaptation) across a business’s Scope 1, Scope 2 and Scope 3 footprint. The remaining carbon budget that is left is then assessed for whether the natural environment in its current state can absorb it. If it can’t (which is the case across the board in our current environment) additional natural carbon ‘sinks’ are created/ invested in to further capture and lock up this carbon. To deliver the Paris Climate Agreement, the Intergovernmental Panel on Climate Change (IPCC) has confirmed that we need to be net zero globally by 2050 with a c. 50% reduction in emissions by 2030.

A reduction or removal of emissions of carbon dioxide or other greenhouse gases. An offset is made in order to compensate for emissions made elsewhere.

Companies who demonstrate strong ESG performance and with no major controversies (e.g. bribery or child labour) but which don’t necessarily aim to tackle sustainability through their products and services. We don’t directly* invest in these businesses at Tribe.

*Whilst we don’t have direct investment in these businesses some of the funds we hold may do so.

The Oxford Principles for Net Zero Aligned Carbon Offsetting (the “Oxford Offsetting Principles”) outline how offsetting needs to be approached to ensure it helps achieve a net zero society.

Passive investing is a style of investment management associated with mutual and exchange-traded funds (ETFs) where a fund’s portfolio tracks a market index.

Charitable acts, often generous donations of money, to good causes with the view of helping others or society as a whole.

Pooled securities or pooled funds — also known as collective investment schemes — are a way of putting sums of money from many people into a large fund spread across multiple investments and managed by professionals.

The percentage of a portfolio that comprises a certain holding or type of holding.

The six Principles for Responsible Investment provide actions for incorporating ESG factors into investment practices.

Principle 1: We will incorporate ESG issues into investment analysis and decision-making processes.

Principle 2: We will be active owners and incorporate ESG issues into our ownership policies and practices.

Principle 3: We will seek appropriate disclosure on ESG issues by the entities in which we invest.

Principle 4: We will promote acceptance and implementation of the Principles within the investment industry.

Principle 5: We will work together to enhance our effectiveness in implementing the Principles.

Principle 6: We will each report on our activities and progress towards implementing the Principles.

The principles are overseen by PRI which is a leading, independent proponent of responsible investment. It works to understand the investment implications of environmental, social and governance (ESG) factors and to support its international network of investor signatories in incorporating these factors into their investment and ownership decisions.

Investment into a company that’s not publicly traded, either directly or through a fund.

Equity and debt investments that are held by individuals or corporates and where there is limited ability to easily buy or sell securities.

Investments in real estate. Value is determined by changes in government regulation, interest rates or wider market demand.

Equity and debt investments traded on a public exchange enabling wide, public ownership.

A company who owns, and in most cases operates, income-producing real estate. REITs own many types of commercial real estate, including office and apartment buildings, warehouses, hospitals, shopping centres, hotels and commercial forests.

Evidenced reductions in greenhouse gas emissions that can be traced, measured and qualified over time using data. The reductions are from actual decarbonisation activities, rather than forecasted or predicted emissions reductions or those emissions reductions that occur as a result of a change in asset allocation, for example.

Energy production technology that relies on unlimited natural sources, such as wind and solar.

Working within the main asset classes and securities, responsible investing covers a range of activities from exclusion/negative screening, through themes (cleantech, water, etc.), corporate engagement, to positive screening.

The UN established the Principles for Responsible Investing in order to promote this movement. One of the key tools in sustainable investment are environmental, sustainable and governance metrics (ESG). There are criticisms of a reliance on ESG because it focuses on companies’ activities, rather than their products and usage. Additionally, there are no uniform standards for ESG data which means it can be subject to varying levels of attestation, accuracy and audit.

Accounts for the potential return/profit of an investment whilst considering the potential risks and volatility that must be accepted with that investment in order to achieve it.

Assesses an investor’s level of willingness and ability to tolerate investment risk and the tradeoff between potentially earning a higher return or having a lower chance of losing money in a portfolio.

The methodology that the Science Based Target initiative developed specifically for the financial services sector to help them understand how to set a Science Based Target. It can be found here.

Provide a defined pathway for companies to reduce greenhouse gas (GHG) emissions, helping prevent the worst impacts of climate change and future-proof business growth. Targets are considered ‘science-based’ if they are in line with what the latest climate science believes is necessary to meet the goals of the Paris Agreement — limiting global warming to below 2°C above pre-industrial levels and pursuing efforts to limit warming to 1.5°C.

Direct emissions from all business activities including emissions from any owned facilities and owned transport.

Indirect emissions from all electricity purchased by a business.

Other direct emissions from all activities, occurring from sources that aren’t owned or controlled by a business. These are usually the greatest share of any business’s carbon footprint, covering emissions associated with business travel, procurement, waste and water. For Tribe, this includes the investments we make.

A tradable financial asset in an individual company such as a share or a bond.

Smaller or mid-sized companies. Definitions vary by country, but in the US, companies up to a $10bn market cap. These companies may involve a higher degree of investment risk and volatility given there may be less publicly available information about the company and they tend to be less frequently traded on account of their smaller size.

Social Investments are defined as the provision and use of repayable finance to generate social as well as financial returns. Social investment may occur in a variety of forms such as loans, equity and bonds.

Social returns are improved outcomes for society and range substantially – from, for example, improved individual health to employability amongst disadvantaged groups, to provision of community goods and services, to the community impact of reduced carbon emissions. Financial returns imply that the social investor will be able to get their money back in the future with a return. By this definition, grants, donations and other funds with no expectation of being paid back are not social investments”

Housing provided for the disadvantaged or with specialised requirements, usually funded by local or central government.

Socially Responsible Investing (SRI) Investing typically seeks to maximize returns within a framework of personal values. It employs three primary strategies: investment screening and Environmental, Social & Governance (ESG) analysis, shareholder advocacy and community/impact investing. The desire to have social impact and generate meaningful financial returns is driving the growth of SRI investment strategies.

The use of influence by institutional investors to maximise overall long-term value including the value of common economic, social and environmental assets, on which returns and clients’ and beneficiaries’ interests depend.

Investment styles with certain attributes related to growth, value, geography and size.

Meeting today’s needs without compromising the ability of future generations to meet their needs, by working towards the attainment of the UN SDGs.

A range of measures being proposed by the UK’s Financial Conduct Authority (FCA) to develop and implement new sustainability-related financial disclosure requirements (‘disclosures’) and a sustainable classification and labelling system for investment products (‘labels’) in the UK for the financial services sector.

It is currently being finalised and covers 6 main areas:

Mandatory ESG disclosure obligations for asset managers and other financial market participants. As of 10 March, 2021, SFDR enforces sustainability disclosure obligations for manufacturers of financial products (such as Undertakings for the Collective Investment in Transferable Securities (UCITS) and alternative investment funds (AIFs)) toward end-investors. It does so in relation to the integration of sustainability risks by financial market participants (i.e. asset managers, institutional investors, insurance companies, pension funds, etc., all entities offering financial products where they manage clients’ money) and financial advisers in all investment processes and for financial products that pursue the objective of sustainable investment. In addition, disclosure obligations in relation to adverse impacts on sustainability matters were added at entity and financial product levels, i.e. whether financial market participants and financial advisers consider negative externalities on environment and social justice of the investment decisions/advice and, if so, how this is reflected at the product level.

The EU SFDR applies to all financial market participants and financial advisers based in the EU. Investment managers or advisers based outside of the EU, who market (or intend to market) their products to clients in the EU under Article 42 of the Alternative Investment Fund Managers Directive (AIFMD), will also need to follow the SFDR disclosures.

Tribe’s Sustainable Investment Model Portfolio Service (SIMPS). The SIMPS portfolio range provides a combination of risk-adjusted returns and positive impact. SIMPS are liquid portfolios of daily traded funds and are rebalanced at least quarterly. The SIMPS is accessed via a financial adviser.

Development that meets the needs of the planet without compromising the ability of future generations to meet their own needs.

A Tribe portfolio theme which involves investing in businesses and institutions that prioritise the natural world and improve the well-being of people and communities through things like energy efficiency, circular technologies energy efficiency, circular technologies education and healthcare.

Companies who demonstrate strong ESG performance, with no major controversies, and which derive at least 50% revenue from products and services aligned with the delivery of the SDGs. We aim to invest in these businesses at Tribe.

A temperature pathway is an intended or forecasted change in the absolute warming that happens at global level over time. For example, the Paris Agreement’s goal is to limit global warming to well below 2 degrees, preferably 1.5 degree, which means reaching net zero in terms of emissions by 2050. A portfolio, therefore, may currently, with no changes in underlying business practices, currently be forecast on a pathway for 2.5 degrees of warming by 2050. An intended pathway would be to reduce that portfolio to no more than 1.5 degrees of warming by 2050.

Testing

The Paris Agreement is a legally binding international treaty on climate change. Its goal is to limit global warming to below 2°C, preferably to 1.5°C, compared to pre-industrial levels. This means reaching net zero in terms of emissions by 2050. It was adopted by 196 Parties at COP21 in Paris in 2015.

The exposure levels to certain geographies, industries, businesses and / or issues that are set at the portfolio level to ensure a maximum level of exposure.

Typically implies standard shares and bonds.

Companies who demonstrate strong ESG performance, with no major controversies and which derive at least 10% revenue from products and services aligned with the delivery of the SDGs. We invest in a small number of these businesses at Tribe that demonstrate a clear commitment to transitioning to future-fitness.

A transition pathway identifies areas of measures and performance improvement for a social, environmental and/or economic transition. For example, for a green transition in support of a low carbon future a transition pathway will include measures linked to decarbonisation to drive that change.

Tribe’s two separate assessments of an investment’s financial and impact credentials — the potential monetary returns it may deliver as well as its social and environmental outcomes. The financial due diligence is led by Tribe’s chief investment officer and the impact due diligence is led by Tribe’s chief impact officer.

The Sustainable Development Goals (SDGs), also known as the Global Goals, were adopted by the United Nations in 2015 as a universal call to action to end poverty, protect the planet, and ensure that by 2030 all people enjoy peace and prosperity. There are 17 goals. The goals recognise that ending poverty and other deprivations must go hand-in-hand with strategies that improve health and education, reduce inequality, and spur economic growth – all while tackling climate change and working to preserve our oceans and forests.

A person with investible assets in excess of £20 million (thresholds can vary).

The process of reclaiming raw materials from waste products sent to landfill. This includes extracting rare metals from discarded waste electrical and electronic equipment (WEEE).

See also:

Waste Electrical and Electronic Equipment (WEEE)

The risk of loss arising from the difference between the price of an instrument reported on a bank’s balance sheet – as determined by accounting rules – and the actual price a bank would obtain if it sold that instrument (if it is an asset) or the price a bank would pay to buy it or transfer it to a third party (in the case of a liability).

A statistical measure of the dispersion of returns for a given investment. This is used by investors as a standard measurement of risk i.e. generally higher volatility is viewed as higher risk.

Most commonly computes the contribution of a company’s current activities towards climate change. The MSCI methodology we use states warming potential delivers an exact temperature value that signifies which warming scenario (e.g. business as usual (BAU) 3°C, 2°C, 1.5°C etc.) the company’s activities are currently aligned with.

Any electrical or electronic waste, whether whole or broken, destined for disposal.

WEEE includes household appliances (e.g., fridges and cookers), telecommunications equipment IT (e.g., computers, printers, and servers), electrical and electronic tools, toys and leisure equipment, and certain medical devices (e.g., dialysis machines).

Occurs when demand for water exceeds the available amount during a certain period or when poor quality restricts its use.

A return measure for an investment over a fixed period of time.