Engaging your client

An introduction to Tribe’s SIMPS

What if your wealth actually reflected your values?

Meet the wealth managers who share your commitment to reshaping the world for the better.

Download – An introduction to Tribe – brochure (for financial advisers & clients of advisers)

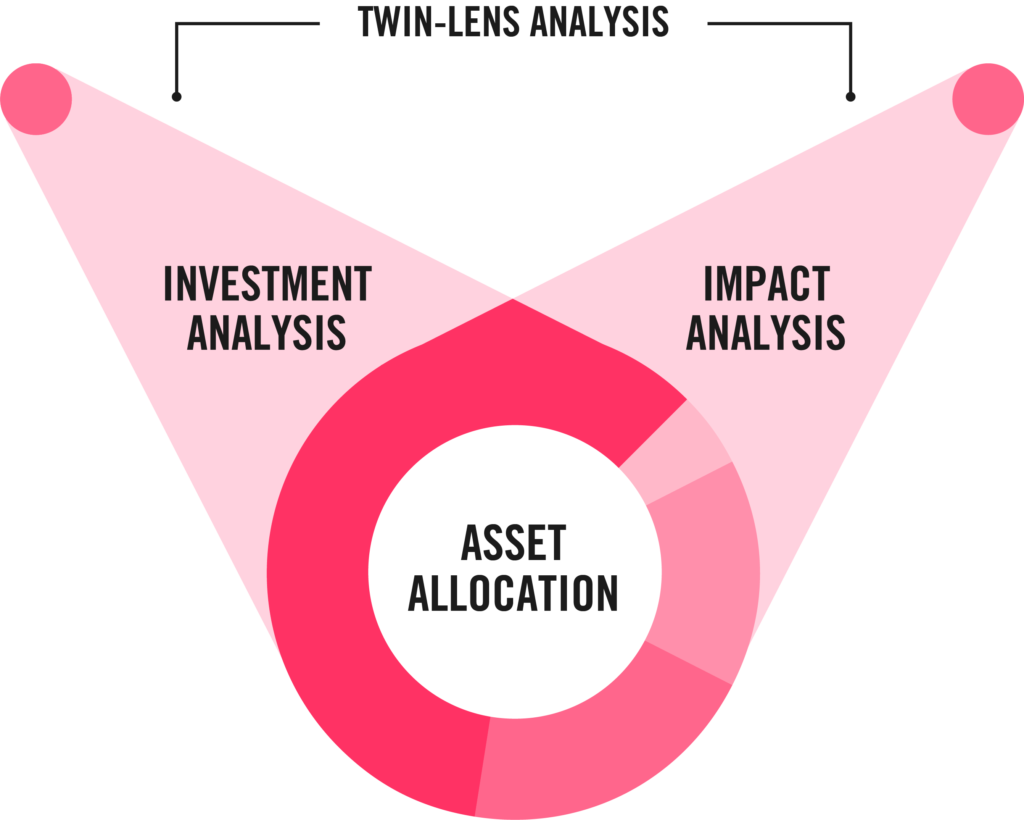

How we invest

Our investment process is built around the people who invest with us – by combining their financial aims, values, and the progress they want to see in the world.

- Build a purposeful portfolio

- Be part of the solution

Choose a client

Have a client who wants to invest in climate and environmental solutions or one that’s particularly focused on solving global social challenges like inequality and access to education? Select your client type below and use the suggested documents in your conversations to engage your client in investing for the change they want to see.

For investors who want to align their investments to ethical and/or moral principles. To avoid certain companies or industries such as tobacco, alcohol, firearms etc.

For investors concerned about the climate crisis, who are already taking steps in their personal lives to reduce their carbon footprint, recycle or eat less meat and want to align their investments.

For all investors, impact investing offerings diversified investment returns from traditional portfolios and an opportunity to do some good at the same time.

Latest CPD webinars

We host regular webinars for our adviser community on a variety of investment and impact topics. To be invited to our upcoming webinars – please email advisers@staging.tribeimpactcapital.com

We’ll discuss the latest investment performance and outlook for the Sustainable Impact MPS (SIMPS) portfolios, including:

- The macro-economic environment and what is driving financial markets

- Review of Q2 performance and outlook for upcoming quarters

- Asset allocation and portfolio changes

- Q&A

Hosted by Christopher Toy, Business Development Manager and Jamie Innes, Investment Manager

Eligible for 30 minutes of unstructured CPD.

We’ll discuss the latest investment performance and outlook for the Sustainable Impact MPS (SIMPS) portfolios, including:

- The macro-economic environment and what is driving financial markets

- Review of Q1 performance and outlook for upcoming quarters

- Asset allocation and portfolio changes

- Q&A

Hosted by Aaron Gaide, Business Development Manager and Jamie Innes, Investment Manager

Eligible for 30 minutes of unstructured CPD.

We’ll talk through the latest investment performance and outlook for the Tribe portfolios, including:

– The macro-economic environment and what is driving financial markets

– Review of performance in 2022 and outlook for 2023

– Asset allocation and portfolio changes

– Q&A

Hosted by Christopher Toy, Business Development Manager and Jamie Innes, Investment Manager

Eligible for 30 minutes of unstructured CPD.

In partnership with Lee Coates OBE, from ESG Accord, join us as we examine the ongoing regulation changes for the financial advice industry.

We’ll look at how advisers could be affected, with a specific focus on:

- What are the FCA’s Sustainability Disclosure Requirements (SDR) and new labels for sustainable investments?

- How does consumer duty intersect with the sustainable finance rules?

- When will these changes come through and what should advisers do?

Hosted by Business Development Managers Aaron Gaide and Christopher Toy, along with special guest Lee Coates OBE, Co-founder of ESG Accord.

Eligible for 30 minutes of unstructured CPD.

The Inflation Reduction Act allocates more than US$370 billion in incentives and programmes to accelerate action on climate and energy over the next decade.

In this session, we’ll break-down what this means for investors and the Tribe SIMPS, including:

- What is the Inflation Reduction Act? And why is it so important?

- What does it mean for investors and climate change?

- Which sectors and companies will benefit from the policy action?

- What can we expect in the future?

Hosted by Christopher Toy, Business Development Manager, Jamie Innes, Investment Manager and Rob Hurford, Investment Analyst

Eligible for 30 minutes of unstructured CPD.

In this webinar, we talk through the latest investment performance and outlook for the Tribe SIMPS portfolios, including:

- Investment performance and how Tribe is positioned versus traditional portfolios

- The macro-economic environment and what is driving financial markets

- Our outlook for sustainable investments and the SIMPS portfolios

- Recent SIMPS portfolio changes

Hosted by Christopher Toy, Business Development Manager and Jamie Innes, Investment Manager.

Eligible for 30 minutes of unstructured CPD.

The war in Ukraine has reminded governments and investors that goals to decarbonise and promote energy efficiency are linked to geopolitical energy security requirements.

In this webinar Tribe’s Chief Investment Officer, Fred Kooij considers:

- What are governments doing to accelerate investment away from fossil fuels?

- Which sectors and industries are critical to support the shift away from fossil fuels?

- What are the implications and outlook for the SIMPS portfolios?

Hosted by Aaron Gaide, Business Development Manager and Fred Kooij, Chief Investment Officer.

Eligible for 30 minutes of unstructured CPD.

In this webinar, with Lee Coates OBE, Co-founder of ESG Accord, we discuss some of the current challenges advisers are facing:

- What are the existing rules around sustainability and suitability and how do you ensure you’re compliant?

- Where is the FCA regulation heading and what does it mean for advisers and their advice process?

- How do you ‘ask the question’ and what to do with the answer?

Hosted by Christopher Toy, Business Development Manager and Lee Coates OBE, Co-founder of ESG Accord.

Eligible for 30 minutes of unstructured CPD.

Get in touch

To sign up to our monthly updates contact our advisers team today.

For investors that advocate for quality education, gender equality, eradication of poverty and/or other social causes that their investments can support.