Our path to net zero

Why net zero?

In September 2019, we were one of the first wealth managers globally to declare a

Net Zero

Scope 1

Scope 3

- The need to accelerate our transition to a low carbon economy as global citizens, businesses and governments. One of the most critical issues we all need to address are our

emissions, alongside our over-consumption that has led to catastrophic declines in wildlife and wildlands. Declaring a climate emergency in 2019 and committing to being net zero is our response to the

Greenhouse gas

The six main greenhouse gases covered by the Kyoto Protocol: Carbon dioxide (CO2); Methane (CH4); Nitrous oxide (N2O); Hydrofluorocarbons (HFCs); Perfluorocarbons (PFCs); and Sulphur hexafluoride (SF6). It is part and parcel of being a responsible wealth manager and a responsible businessClimate crisis

The catastrophic and fast accelerating nature of global warming currently being experienced. - Being aware of the increasing level of financial risk the climate crisis poses us a wealth manager is essential. We are otherwise at risk of transgressing our responsibility to manage the risks our clients’ capital is exposed to. To be able to manage this risk we have to understand it, measure it, and reduce it. Our commitment to net zero is a part of this.

- The global finance sector, wealth and asset management in particular, has a significant role to play in reducing levels of greenhouse gas emissions and associated global warming. Our investment thesis (investing only in sustainable businesses solving global problems) and business model (B Corp), place us in a position to help establish pathways to address the problem. We don’t have all the answers, but by sharing our learnings and findings we hope that as an industry we can progress and collectively improve.

What are greenhouse gases?

There are several forms of greenhouse gas. Six are covered by the

Kyoto Protocol

Carbon equivalency

What needs to be measured?

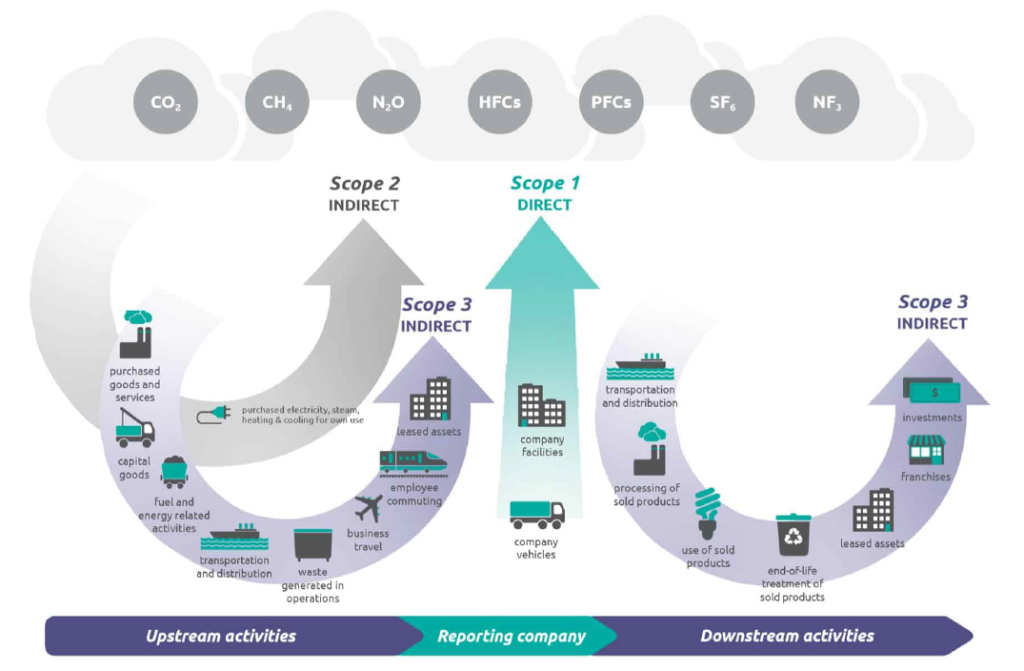

Greenhouse gases can be emitted in many different ways, through various activities. Therefore, emission volumes are measured and reported across three areas.

Scope 1: direct emission from all activities including emissions from any owned facilities and owned transport.

Scope 2: indirect emissions from all electricity purchased.

Scope 3: other indirect emissions from all activities, occurring from sources that aren’t owned or controlled. These are usually the greatest share of any business’s carbon footprint, covering emissions associated with business travel, procurement, waste and water. For Tribe, this includes the investments we make.

Source: Overview of GHG Protocol scopes and emissions across the value www.ghgprotocol.org

What is net zero?

The team at the

Grantham Institute at Imperial College state,

1

“‘net zero’ refers to achieving an overall balance between emissions produced and emissions taken out of the atmosphere”. Like a bath with the taps on, an approach to achieving this balance can either be to turn down the taps (the emissions) or to drain an equal amount down the plug (removing emissions from the atmosphere, including storage for the emissions such as ‘carbon sinks’). Net zero is when we’re able to demonstrate that through our actions we’ve reduced our total CO2e ‘bill’ to nil.

How will we do this?

The honest answer is we’re still working through the best approach to do this. We have some of the toolkit we need to better understand the carbon footprints of some of our investments (e.g. the Carbon Delta Warming andClimate Value at Risk tools along with the great work of

CDP’s

2

global disclosure system) but more reporting is needed – we can only measure what’s reported. We also have access to collaborations such as the

Partnership for Carbon Accounting Financials (PCAF)

3

and the

Science Based Targets Initiative

4

as well as the

United Nations-convened Net-Zero Asset Owner Alliance

5

and the

Net Zero Investment Framework

6

by the Institutional Investors Group on Climate Change. These offer complementary approaches but there are still some big questions around how to measure and where to measure across a multi-asset class portfolio.

As per our Impact Report, we have historically reported on

Absolute carbon

Equity

It’s for this reason we took the opportunity last year when we declared our net zero commitment to also sign up to the

Science Based Target (SBT)

Our approach to achieving net zero is simple and includes practices from the recently released Oxford Principles for Net Zero Aligned Carbon Offsetting (the “Oxford Offsetting Principles”) 8

- Track and trace the carbon across our own business activities and actively manage the emissions;

- Reduce: refine our investment thesis to reduce down

emissions by working with companies;

Greenhouse gas

The six main greenhouse gases covered by the Kyoto Protocol: Carbon dioxide (CO2); Methane (CH4); Nitrous oxide (N2O); Hydrofluorocarbons (HFCs); Perfluorocarbons (PFCs); and Sulphur hexafluoride (SF6) - Manage: fund managers to support and further improve their climate related performance at company and/or fund level; and

- Offset: our last resort, where carbon emissions remain, use smart and robust carbon offsets to drive us to zero. This is where the Oxford Offsetting Principles will guide us. Historically, we have partnered with Climate Care (another B Corp) to help us do this across our Scope 1 and 2 emissions.

There is a fourth category which is repair. This is where we actively invest to drive us to carbon negativity. This is going beyond net zero and positioning Tribe as a quasi-carbon sink (through all our activities). We are currently investigating this.

We’re a small business with a big vision. We don’t have all the answers and we’ll always report honestly and in line with best practice. We won’t make claims we can’t substantiate and we’ll always be transparent when it comes to the methods we’ve used to support what we say. We actively seek input and partnership. We passionately believe that together we’re stronger, and that together we go further. With that in mind, we’re always seeking additional ideas and counsel as to what we could do to drive us where we want to be, ahead of schedule. Please drop us a line. You’ll find us a receptive crowd, eager to learn more.