Impact investing is long-term investing

At Tribe, we believe impact investing should be considered orthodox, long-term investing. We draw inspiration from learnings from the likes of Warren Buffet and his “forever” investment timeframe and Howard Marks’ “second order” thinking to bolster our methodology. The difference is the emphasis we place in prioritising positive investments that directly contribute to global sustainable development and address a social, economic or environmental issue society is facing.

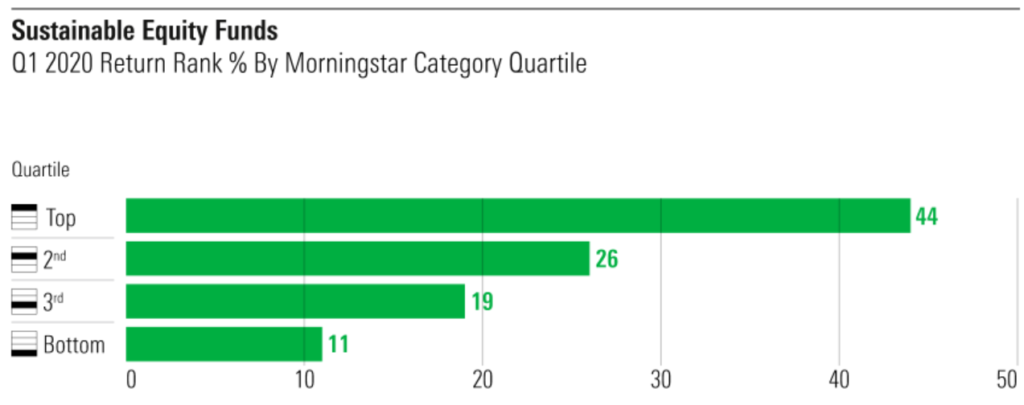

Over the last few weeks, much has been written about how well ESG strategies have performed through the COVID-19 market crisis. Morningstar, in a detailed study (see Appendix), noted an overall outperformance for ESG labelled strategies. They found this was mainly attributable to an aggregated combination of ESG strategies being underweight in energy, overweight in technology, with further alpha being added by an overall superior stock selection. Of more significance, we believe, COVID-19 has brought to the fore, the businesses that are supporting and driving the world through this crisis. The businesses that are demonstrating their ingrained sustainable practices across all metrics which is allowing them to not only weather the storm but help others to do so also.

While this is a helpful short-term data point; we continue to look ahead at the longer term and focus on refining our process to position ourselves for the metanarrative which we think will define all investing over the course of the next decade. While sceptics may question our “values centric” ways, we believe that our

Twin-lens

So, what does long-term investing actually mean for us? Our investment selection approach, seeks to uncover opportunities that offer strong societal and environmental benefits, in combination with attractive financial attributes. We are looking for well-run businesses or “compounders” who are driving long-term sustainable economic growth and we set our investment timeframe as “forever” (which is made easier given that

Sustainability

This may all seem like pretty standard practice, however, the central sustainable theme that we seek to compound happens over time. The current COVID-19 crises and its impact on society demonstrates the intrinsic benefit of a long-term investment approach where

Sustainability

Externalities

Externalities

The current COVID-19 pandemic should act as a catalyst for companies to re-cast their systemic role and responsibility, or investors will quickly recognise that companies who don’t understand this will, at best, have significant additional costs coming or, at worst, fail to respond and damage their long-term competitiveness. This crisis has already seen governments committing vast sums to help support the economy – they will want a return on their investment. This is providing a timely opportunity to ensure companies cover all the costs of their business that they might otherwise be seeking to socialise. We have already seen the banks, the focus of much outrage given the generous terms of their bail outs during the 2008 financial crisis, noticeably quick to respond to government pressure not to pay their dividend, which suggests some lessons have been learned. There has been a great deal of attention on part of the US airline industry, amongst others, who have been confident they could rely on a government “put” that they have diverted nearly all their recent free cash flow into share buy-backs. It remains to be seen how acceptable future buy-back programmes will be after this crisis passes, given the other potential uses of cash to benefit other corporate stakeholders. The COVID-19 crisis itself, and government and society response to it, needs to compel companies to consider the needs of all stakeholders. Identifying those companies that already understand this, will be the key to identifying the long-term winners.

So, for us at Tribe, we hope that the lesson from Q1 2020 is not only that ESG aligned funds and companies can compete from a returns perspective and even outperform. But also the realisation that a long-term approach, across all sustainable investment metrics, will deliver the best returns for investors, as well as the planet, economy and society.

Appendix – Morningstar Direct

During the first quarter, the returns of sustainable

Equity

Equity

Equity