Building a purposeful portfolio

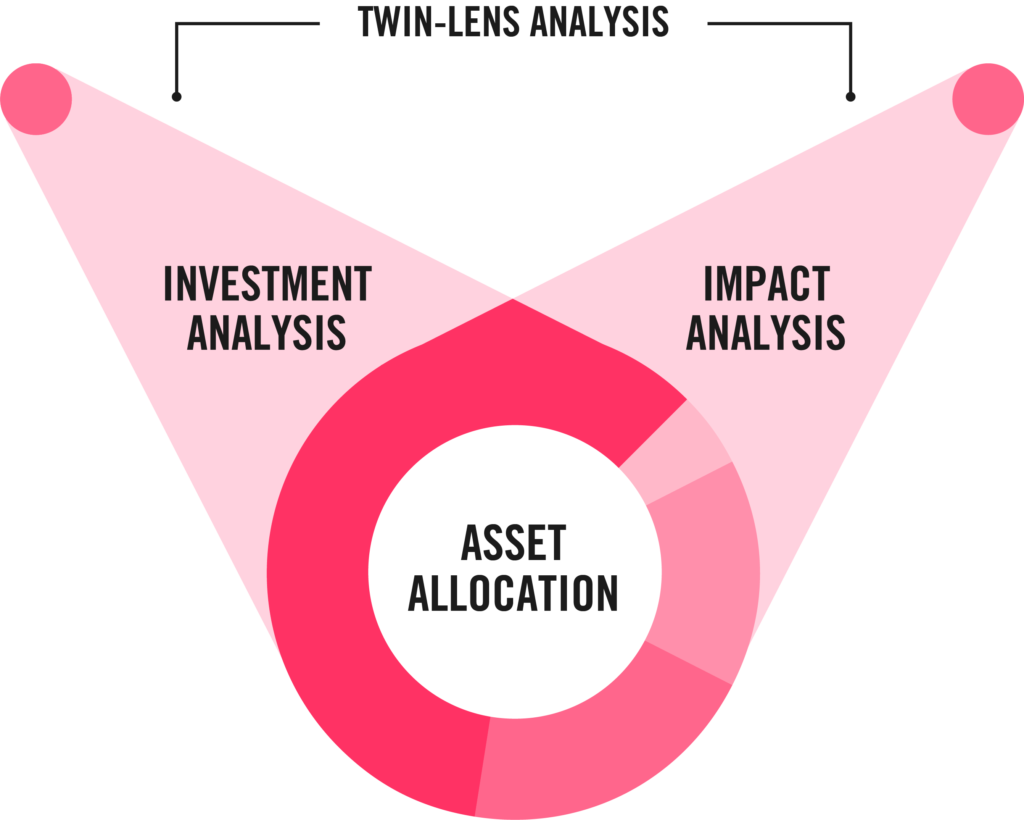

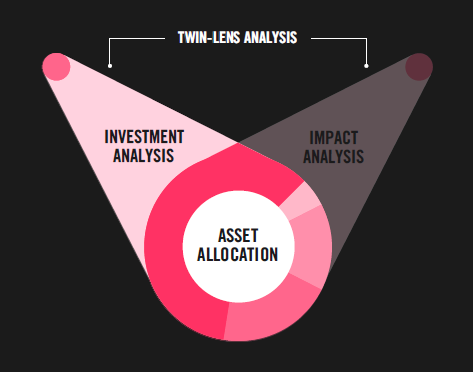

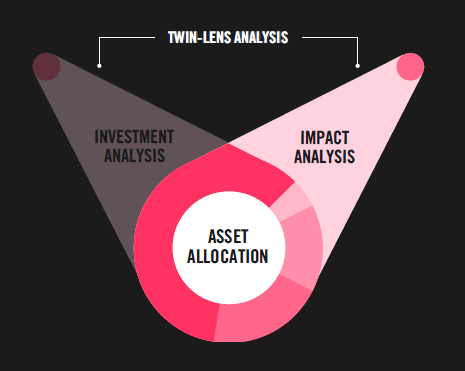

At Tribe, every investment is assessed for both its financial and impact credentials: the potential monetary returns it may deliver as well as its social and environmental outcomes.

We call this our ‘

Twin-lens

Investment universe

This isn’t just about negative screening; it doesn’t simply mean ruling out investing in companies with bad practices. Instead, our approach takes a much more detailed view of which opportunities may have a positive impact.

These two due diligence processes — of investment and impact — run in parallel, with each team having a say over whether an investment is approved. While their processes are separate, the teams work closely together to understand the merits and/or potential risks of an investment.

This means an investment can be rejected if there is evidence of strong financial returns but fails to meet our stringent impact criteria, and vice versa. Having these high minimum requirements ensures the investments we select for our portfolios hold the appropriate levels of sustainability.

This approach allows us to ensure that the long-term impact goals of the people who invest with us are being met alongside their financial ones.

Investment lens

The investment process starts with the global macroeconomic analysis which is used to frame our strategic asset allocation. Once this is established we look at our universe of existing investments and incorporate those we believe can improve the risk or return of our portfolios. When sourcing new investments, we look for opportunities that enhance the offering of our existing investment universe; offering more value, being cheaper or being more innovative. They could also provide access to a new asset class, geography, or sector that we believe will outperform existing investments in the medium term.

The investment team also considers whether the investment is attractively valued and whether it offers an acceptable level of risk. In order to reduce

Volatility

Style factors

Historic scenario tests

Impact lens

Our impact lens analyses each investment opportunity against the UN Sustainable Development Goals (

UN Sustainable Development Goals (UN SDGs)

Environmental, Social and Governance (ESG)

Each company that we could potentially directly invest in — and which has more than 50% of its revenue aligned with the SDGs — goes through a further level of assessment. We do this through our

Additionality Materiality Intentionality Framework (AMI)

Additionality

Materiality

Intentionality

We then look at three levels of likely impact for

Pooled securities

Single security

Public market

Private market

Operational impact

Low carbon transition

Systemic impact

Join the Tribe

Start realising the potential of your wealth by speaking to one of our Wealth Managers today.