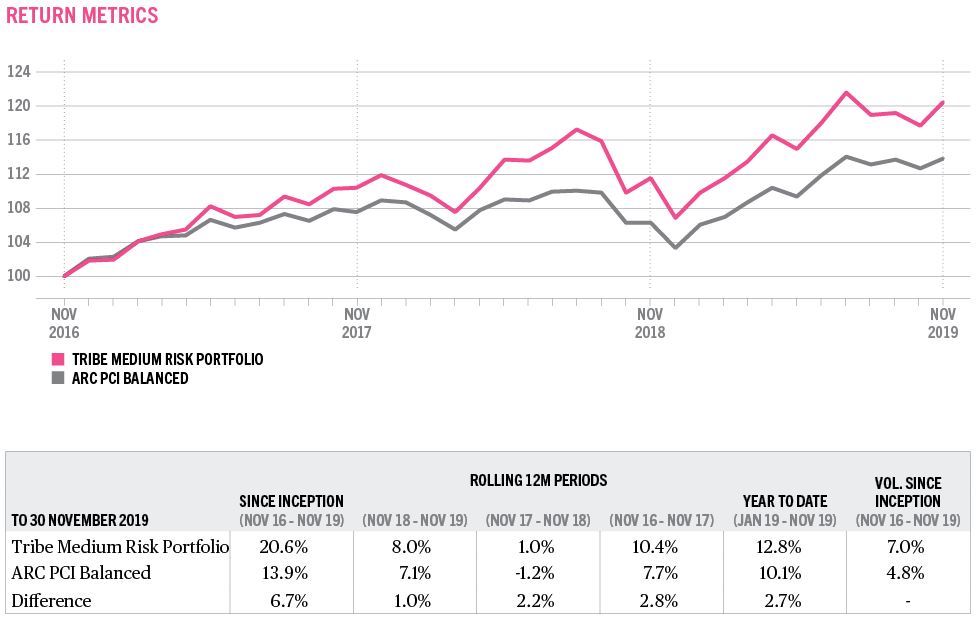

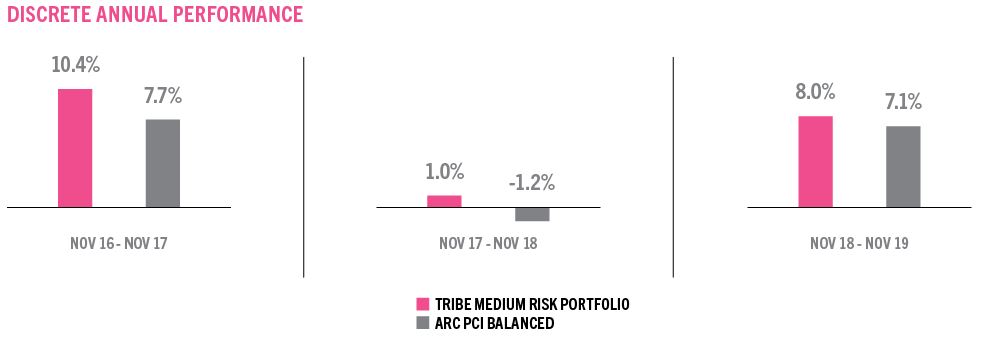

On 30th November, 2019 we celebrated three years of running active portfolios. Whilst past performance is not a good indicator of the future, we believe the results highlight both the strength of our investment process over this multi-year period and that impact investing can deliver a strong risk adjusted performance. Investing in well-run businesses trying to solve major challenges means you can do well and do good.

Our Medium Risk Portfolio returned 20.6% (net of fees)1over the three-year period, compared to the “ARC PCI Balanced Benchmark”, which returned 13.9%.2 (ARC benchmarks are calculated by collecting actual performance from over 50 investment managers).

The impact

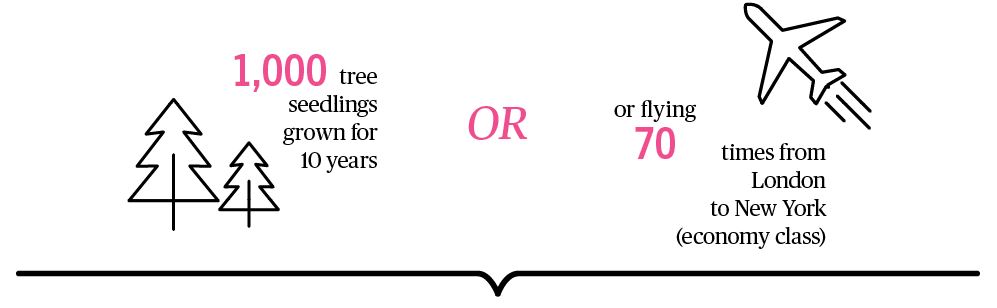

In addition to financial performance, we seek to generate positive social and environmental returns with our portfolios. By investing £1m in the Medium Risk Portfolio rather than in a representative basket of the investable universe,3 you would have saved 60 tons of carbon dioxideCarbon dioxide (CO2)CO2 is an important heat-trapping (greenhouse) gas, which is released through human activities such as deforestation and burning fossil fuels, as well as natural processes such as respiration and volcanic eruptions. read more.4 That represents:

Our process and philosophy

We seek to distinguish ourselves by building multi-asset class portfolios for clients that deliver financial returns in line with their values and the positive change they want to see in the world. Our Medium Risk Portfolio comprises an actively managed selection of our best ideas within a “balanced” allocation to Equities, Bonds, Alternative Investments and Cash. Our investment selection process incorporates a rigorous twin-lensTwin-lensTribe’s two separate assessments of an investment’s financial and impact credentials — the potential monetary returns it may deliver as well as its social and environmental outcomes. read more approach. We assess each investment based on their impact merits to ensure the underlying investments are material and additional contributors to the UN Sustainable Development Goals (UN SDGs), and their investment merits to ensure we buy at sensible valuations within a strong risk management framework. We’re looking for well-run organisations with the solutions to the major societal and planetary challenges we face. As a result of this work, client portfolios incorporate equityEquityThe universe of traded company shares. Investments can fluctuate according to market conditions, the performance of individual companies and that of the broader equity market. read more and debt exposure to organisations that have sustainabilitySustainabilityMeeting today’s needs without compromising the ability of future generations to meet their needs, by working towards the attainment of the UN SDGs. read more and responsibility at the core of their business: those that we believe deliver a net positive impact. Since the outset, our mantra has been to buy impactful securities at a reasonable price. This allows us to deliver a return in line with the market while simultaneously generating positive environmental and social impact. We still encounter the concern that there has to be some performance sacrifice to invest along more sustainable lines; along with the wealth of academic evidence, we hope this track record offers a further data point to dispel this myth.

What we invested in

Looking across the sectors we invest in, our overweight to Healthcare was the biggest contributor to our performance over the three years. We naturally tend not to invest in fossil fuel providers, who make up the bulk of the Energy sector (many of the renewable energyRenewable energyEnergy production technology that relies on unlimited natural sources, such as wind and solar. read more businesses tend to be classified under Utilities or Technology). Avoiding the Energy sector, as well as Financials, also helped our performance. One notable feature of our geographic exposure has been our significant underweight to the United States when we compare the portfolio against the total investable universe.5 This has in part been due to our lack of enthusiasm over the FAANG names that make up such as disproportionate amount of the US market.6 We continue to have a natural bias towards “growth” stocks: those organisations seeking to capture some of the secular growth opportunities around sustainabilitySustainabilityMeeting today’s needs without compromising the ability of future generations to meet their needs, by working towards the attainment of the UN SDGs. read more themes.

How that played out

Our FCA authorisation commenced in November 2016, which was slightly inopportune timing in terms of launching an Impact Investing strategy. Following the election of President Trump in the US, some stocks (for example fossil fuel based energy) rallied, while renewables suffered. The performance on the first day was the third worst to date (-1.5%). Since then, the Medium Risk Portfolio has performed well, helped by a strong overall equityEquityThe universe of traded company shares. Investments can fluctuate according to market conditions, the performance of individual companies and that of the broader equity market. read more rally and we benefited from having an overweight allocation to the asset classAsset classA group of investments or securities which have similar financial characteristics such as equities, fixed income, alternatives and cash. read more throughout this period – averaging 55-60%. The end of 2018 saw the period of greatest relative and absolute weakness in performance; the equityEquityThe universe of traded company shares. Investments can fluctuate according to market conditions, the performance of individual companies and that of the broader equity market. read more market fell driven by an unusual combination of concerns surrounding mounting inflationary pressures, global trade tensions, especially between the US and China, and slowing earnings growth. Our portfolios underperformed in this period as valuations of the mid cap (medium sized business) growth stocks – where we have high exposure – are especially vulnerable to inflationary pressures. We continue to monitor volatilityVolatilityA statistical measure of the dispersion of returns for a given investment. This is used by investors as a standard measurement of risk i.e. generally higher volatility is viewed as higher risk. read more and continue to have a high allocation to “Alternatives”. We believe that our offering within these Alternatives, which we define as securities uncorrelated to equityEquityThe universe of traded company shares. Investments can fluctuate according to market conditions, the performance of individual companies and that of the broader equity market. read more and debt markets, serves as a significant differentiator from other managers. For example, we do not invest in commodities, preferring to focus on listed project-based investments in areas such as microfinanceMicrofinanceA type of banking which provides financial services to low income individuals or groups of people who would otherwise have no access to finance. read more, social housingSocial housingHousing provided for the disadvantaged or with specialised requirements, usually funded by local or central government. read more, wind and solar.

Looking out to 2030

We have a long-term nature to our investment horizon, not least as it’s heavily informed by the UN SDGs (which are anchored in a 2030 timetable). We couple this with a focus on businesses seeking to provide solutions to environmental and social challenges, that we believe are well positioned to continue to thrive. These companies should succeed in tapping into certain secular growth opportunities, such as organic food, the circular economy and renewable energyRenewable energyEnergy production technology that relies on unlimited natural sources, such as wind and solar. read more. They also seem likely to have better visibility of the growing business risks associated with our time, for example, the reputational risks within their supply chain, the changing millennial demands or the risk their businesses face as a result of the climate crisisClimate crisisThe catastrophic and fast accelerating nature of global warming currently being experienced. read more. As a result, we believe many of the businesses we invest in are just good investments simply because they are being more thoughtful about future-proofing their earnings, and consequently, their own corporate brands. We believe by continuing to adhere to our twin-lensed investment selection approach in a consistent and rigorous manner, we can continue to deliver both impact and financial performance to our clients.